The level 1 CFA® exam curriculum is heavily skewed towards investment tools (quantitative methods, economics, financial reporting and analysis and corporate finance). This area of the curriculum carries a 49% weighting at level 1. The focus gradually shifts towards portfolio management in the later stages of the program, but for level 1 portfolio management carries only a guideline 7% weighting.

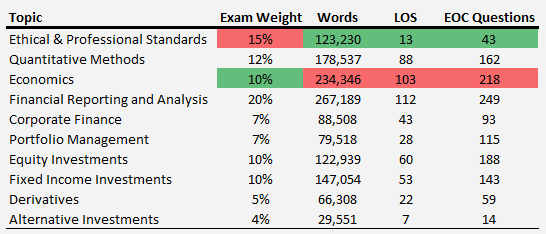

You cannot afford to neglect any part of the curriculum when studying for the test, but it is still valuable to have an idea about how much effort is required for each topic, compared to the weighting on exam day. In the table below I have listed the 10 curriculum topics, in the remaining columns I have identified the topic weight on exam day, the topic weight in terms of words, the number of Learning Outcome Statements (LOS) that you need to master, and the number of End Of Chapter Questions (EOC Questions) that are provided for each topic in the underlying curriculum.

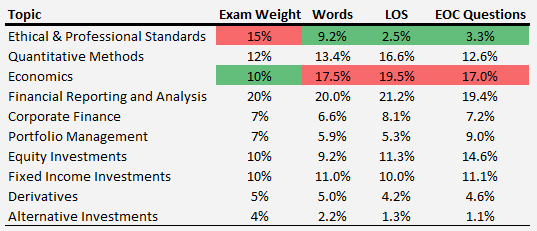

As should quickly become apparent from observing the above table there is a fairly strong relationship between the topic weight for the exam, and the topic weight in the curriculum (as represented by the number of words, LOS and EOC Questions) for most topic areas. There are a few exceptions to this relationship though. Ethics & Professional Standards clearly carries a higher topic weight for the exam than what is justified based on the curriculum, conversely Economics clearly carries a higher topic weight in the curriculum than what is justified based on its exam weighting. You can see the same table with each column calculated as a percentage below (for ease of comparison):

Please not that the topic weights for the exam are sourced from the CFA Institute’s website, and are only intended as a guide. The CFA Institute informs that the “actual exam weights may vary slightly from year to year.” and that “some topics are combined for testing purposes”.

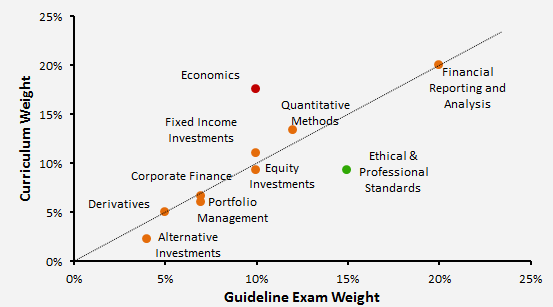

Finally, at the risk of over-engineering my response, the below chart highlights the exam vs. curriculum (pages) weight in a graphical format. The obvious observations to draw from this are that FRA (Financial Reporting and Analysis) is the largest topic area both in terms of it’s exam weight (20%) and weight in the curriculum (20%). As noted above Ethics is the largest outlier to the upside with its exam weight (15%) far outstripping its weight in the curriculum (9.2%), conversely Economics carries a modest exam weight (10%) compared to its weight in the curriculum (17.5%).

So to sum up, you cannot afford to do badly at Financial Reporting and Analysis (given its 20% weight in the test), you are most likely to score “easy” points within Ethics, and if time pressure is forcing you to skim any part of the curriculum, chances are that the damage will be minimized if skim through some of the Economics readings. This is not a recommendation to take Economics lightly though. It is still estimated to make up 10% of the test, so you are likely to face somewhere in the ballpark of 24 questions based on the Economics readings on exam day.

Good luck with your studies!