What is it all about?

Derivatives is clearly one of the more quant oriented topics in the curriculum, so depending on your personal preferences you’ll probably either love it or hate it.

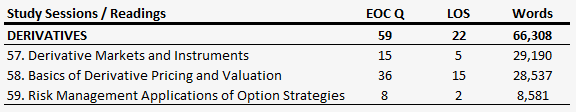

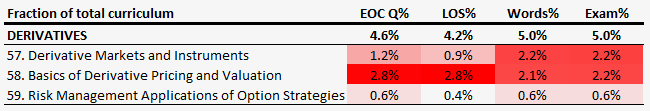

The topic shares space with alternative investments in the very last curriculum book at level 1, and it is confined to one study session made up of 3 relatively short readings. The topic is expected to take up a guideline 5% of the level 1 exam, and it’s weighting in the curriculum is roughly a reflection of that.

The readings

The first reading (26 pages) provides a high level introduction to derivative markets and instrument. Next up is a reading covering the basics of derivative pricing and valuation. The final reading (26 pages) in the study session covers risk management and option strategies.

This study session clearly covers a lot of ground in very little space, and as such the topic very much works as a high level introduction and primer for more to come at level 2 and 3.

Where to focus your attention?

As you can see in the usual topic characteristics table above one of the readings (Basics of Derivative Pricing and Valuation) appears to be slightly more testable (judging by the ratio of LOS and end of chapter questions to curriculum pages) than others. As always, I would advice to take this information with “a pinch of salt”, as the CFA Institute is free to skew the exam towards any reading they like, and as such there is really no way around you having to be familiar with all corners of the curriculum, but if pressed for time this reading would be a good place to focus.

If you would like an explanation about how the guideline exam weights per reading are calculated it is described under the Ethics topic area.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Derivatives and/or if you have got a specific questions about anything else related to your studies.

Next up is Alternative Investments