What is it all about?

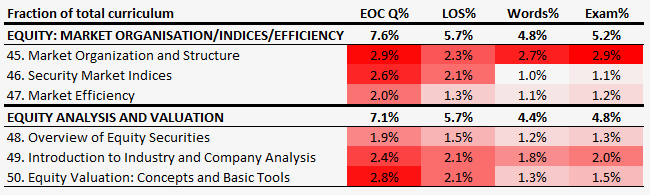

Equity Investments is an average size topic area at level 1. The guideline exam weight as well as the topic’s weight in the curriculum is just about 10%. In this topic area you will learn about how equity markets are structured and analyzed from an investment perspective.

The equity investments readings

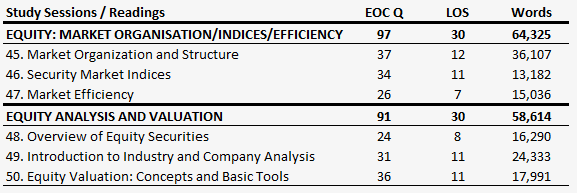

The topic is split in two study sessions, that are further subdivided into 6 readings (3 in each). The very first reading in the first study session (82 pages) contains a slightly long-winded introduction to market organization and structure (covering everything from the essential functions of the financial system to how trade orders are processed). The second reading (42 pages) covers security market indices (how they are constructed, defined and used). The final reading (36 pages) in the first study session delves into the discussion about market efficiency (defining forms of market efficiency and examples of market anomalies).

The second study session is likewise subdivided into 3 readings. The first reading (44 pages) provides an overview of equity securities (common/preferred, public/private, direct/depository receipts etc.). The second reading (62 pages) provides an introduction to company and industry analysis (how are industries defined/delimited and analyzed). The final reading (50 pages) is about equity valuation. Here you will learn some basic tools and concepts including the Gordon growth model and the multistage dividend discount model, that you will refer to a lot throughout the program.

Where to focus your attention?

The two study sessions are roughly comparable in terms of size, LOS statements and end of chapter questions. There are however large deviations between the individual underlying readings. The introductory reading about market organization & structure is clearly the biggest reading in the topic area. Conversely the readings about security market indices, market efficiency and the last reading about basic equity valuation tools and concepts are much smaller but they contain roughly an equal amount of end of chapter questions and LOS statements. As always there is no guarantee that this information provides any clues about the importance of the individual readings on the exam day. But it does give some indication as to how testable they are.

If you would like an explanation about how the guideline exam weights per reading are calculated it is described under the Ethics topic area.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Equity Investments and/or if you have got a specific questions about anything else related to your studies.

Next up is Fixed Income Investments