What is it all about?

If you like formulas and numbers, you’ll love this topic, if not you will probably be pulling your hair out at this one.

Quantitative Methods (Quants) is slightly bigger than your average topic on the exam (The topic is estimated to carry a 12% weight on exam day). However 13.4% of the curriculum text books are dedicated to this topic, and it feels like a lot more, as this is probably one of the slowest topics to read for comprehension. So you can easily find yourself spending way more time on this topic than what is really justified based on its exam weighting.

If you are not time constrained you can obviously just spend the time and rely on the underlying reading. But I think this is a prime example of a topic that lends itself well to study guides. If you are so inclined, I would recommend having a look at the Wiley CFA® Exam Review Products.

I am definitely not in favor of the view that you can skip Quantitative Methods altogether, it carries far too much significance for your final grade, but if you need to cut corners this topic can definitely be summarized. I would still stress that you go through answering all the LOS and end of chapter questions from the underlying curriculum regardless though.

The readings

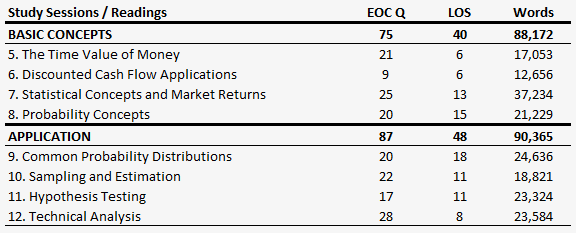

In terms of structure Quantitative Methods is divided into 2 study sessions that are further subdivided into 8 readings as outlined in the table below:

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2015 Exam)

The first two readings about time value of money and discounted cash flow applications may or may not be somewhat basic repetition for you, depending on your background. The 3rd reading about statistical concepts and market returns is a bit of a killer. It’s by far the longest reading in this topic area and if you do not have a background in statistics you may be thrown off particularly by the segment about various measures of distribution (Chebyshev’s Inequality does not exactly sound like a “basic concept”). The first Quants study session is rounded off with a shorter reading about probability concepts.

Where to focus your attention?

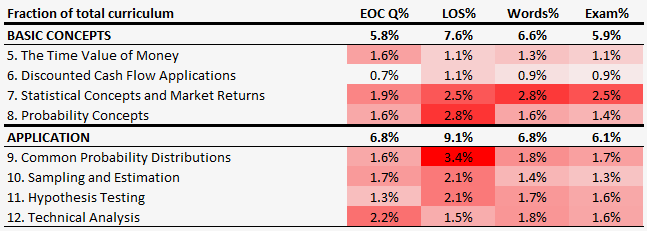

If you observe the concentration of LOS and end of chapter questions, a pattern will emerge that the second study session (application) seems slightly more question heavy than the first (despite being a shorter read). The first reading in this study session is about common probability distributions and Monte Carlo simulation, this reading carries the largest concentration of LOS statements out of all the readings in this topic area. This leads into a relatively short chapter about sampling and estimation (notice how heavily this reading features in terms of end of chapter questions and LOS statements as well). The third reading is about hypothesis testing, before the final reading about technical analysis. The technical analysis reading again seems to have an awful lot of end of chapter questions, compared to its relative brevity. It may be a decoy, and it does not necessarily mean that these readings will be heavily tested on the exam, but if you had to tilt your effort in any way, I would probably make sure that I spent a bit of extra time comprehending the second study session (application), particularly the 40 pages about sampling and estimation.

If you would like an explanation about how the guideline exam weight is calculated for each of the underlying readings have a look at the description under Ethics.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Quantitative Methods and/or if you have got a specific questions about anything else related to your studies.

Next up is Economics