What is Ethics all about?

It’s often easier to grasp a topic if you spend a bit of time considering its meaning rather than just memorizing the facts. Ethics is all about creating trust and safeguarding the integrity of the financial market place. Consider it the basic rules of the game that needs to be met in order to ensure an efficient and trustworthy marketplace. If market participants generally expect each other to live up to these standards, it will be much easier to conduct business. You will have to deal with Ethics on all 3 levels of the CFA® program, so you may as well embrace it from the beginning.

The good thing about Ethics at level 1, is that the readings are relatively short, they make up just 9.2% of the curriculum but are estimated to carry about 15% of the grade on exam day (You should expect somewhere in the neighborhood of 36 questions from this topic area). On top of this your Ethics score could become the defining factor if you are a borderline pass, so there is every incentive for you to pay attention to this topic.

The readings

Ethics “only” takes up 9.2% of the curriculum for level 1 (based on word count). The meatiest reading by far is reading 2 containing a guidance for standards 1 through 7 (6.5% of the curriculum). The reading covers guidance for maintaining your own professionalism(1), how to help maintain the integrity of financial markets(2), your duties to your clients(3) and employer(4), guidelines for conducting investment analysis, recommendations and action(5), how to deal with conflicts of interest(6) and finally your responsibilities as a CFA Institute® member or candidate(7). The exam questions will typically include a short story about financial market participants, and you will have to determine which action(s) comply/don’t comply with the above standards. Apart from this reading you will find a short reading on the code of ethics and standards of professional conduct, an even shorter reading with an introduction to the Global Investment Performance Standards (GIPS) and finally a more through reading on GIPS that could potentially throw off some questions (although a large part of the reading is optional, and therefore not testable on exam day).

Where to focus your attention?

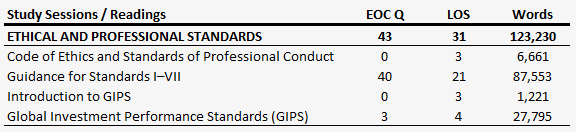

As we described above the entire Ethics topic area provides a very favorable trade-off between its small size in the curriculum and large exam weight. As a result you can afford a slower reading speed when moving through Ethics compared to other topic areas in the curriculum. However, as you can imagine some readings within each topic area are more testable than others. If you take a step back and look at the word count and number of Learning Outcome Statements (LOS) and End of Chapter (EOC) questions across all four Ethics readings, the following pattern emerges:

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2015 Exam)

As you can see from the table above, the density of LOS and EOC questions is by far the highest in reading 2. There is strictly speaking only 3 LOS at the beginning of reading 2, but as each of them apply to all 7 standards, 21 (7*3) provides a fairer representation of the effort required.

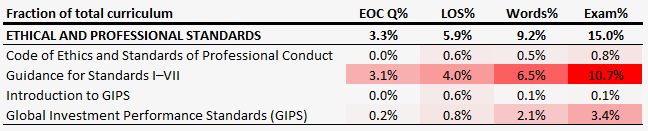

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2015 Exam)

The table above provides an overview of the fraction of the entire curriculum made up by each of the readings and the aggregate topic area. As you can see the topic area contains only 3.3% of the EOC questions, 5.9% of the LOS and 9.2% of the total word count, despite the 15% exam weight. So, no matter how much time you expect to allocate to studying the curriculum it will pay off if you prioritize Ethics. If you are not sure how many hours you can allocate personally have a look at this post. Now looking at the individual readings it should also be clear that despite having the highest proportion of EOC questions and LOS, the second reading still provides a very favorable trade-off compared to the rest of the curriculum.

How do we calculate exam weight per reading?

At this stage you might be curious how the guideline exam weights per reading are calculated? The CFA Institute only provide guideline exam weights at the topic level. E.g. 15% in the case of Ethics. In order to get to the guideline exam weight for e.g. reading 2. We basically divided the word count for reading 2 with the word count for the Ethics topic area and multiply with the guideline exam weight.

Let’s work through an exact example: There are 87,533 words in reading 2 divided by 123,230 words in the entire Ethics topic area. This number (0.71) is then multiplied by the 15% guideline exam weight for the topic area to get to the 10.7% guideline exam weight for reading 2.

A Tip for Reading 2

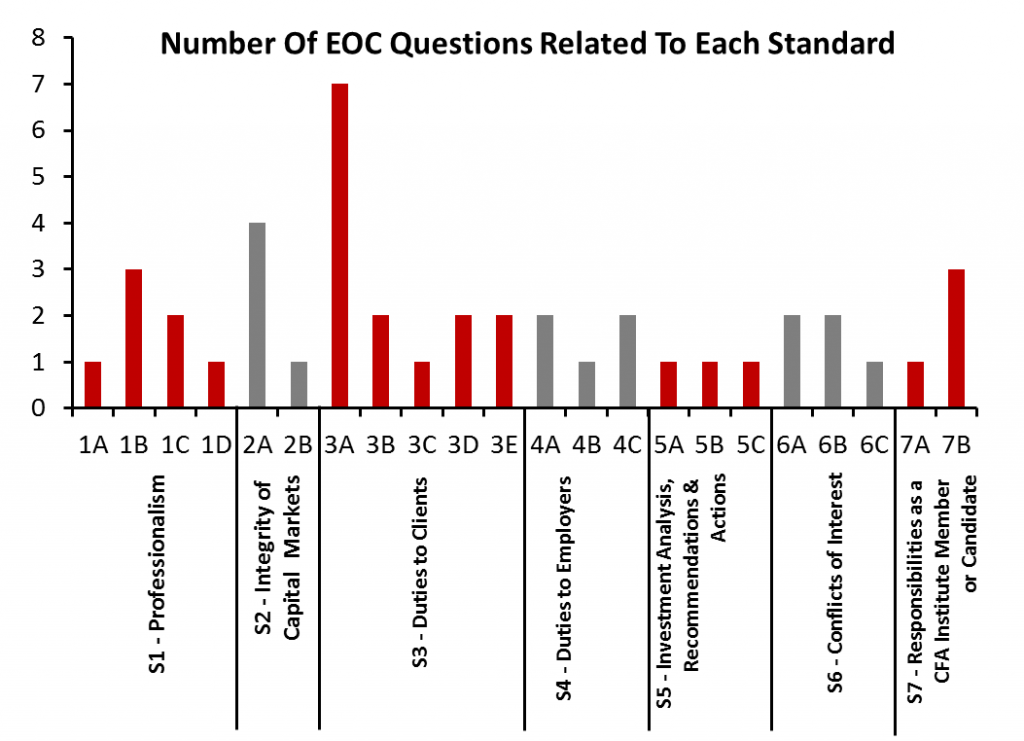

If you browse through the EOC questions for reading 2, you will discover that standard 3 (duties to your clients), and more specifically standard 3A (Loyalty, Prudence and Care) feature heavily (7 questions relate to this substandard). There is obviously no guarantee that 3A will feature heavily on the exam as well, but there is probably no harm in reading this small segment (8 pages) twice, to ensure that you have understood it (1B, 2A and 7B are also frequently referred in the end of chapter questions).

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – December 2014 Exam)

I don’t have much else to say about this topic at this stage, except I would recommend that you go through the curriculum readings rather than relying on a study guide for this topic. This is the topic with the highest reward for time invested, and you want to make sure that you have got a thorough understanding of the material. Make sure that you are able to answer all of the LOS and end of chapter questions, go through them a few times until you can answer every question confidently.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Ethics and/or if you have got a specific questions about anything else related to your studies.

Next up is Quantitative Methods