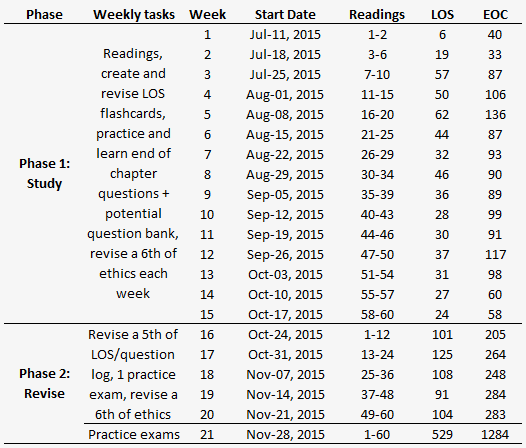

We have finally arrived at the very last week of studying the curriculum. Please remember to record your results in your week 14 progress report. Before we move on, let’s have another look at the program that we have progressed through over the previous 15 weeks:

Source: Financial Exam Academy (Based on the CFA® level 1 exam curriculum – December 2015 Exam)

The week to come:

Even though it may appear daunting to complete Derivatives and Alternative Investments in the upcoming week, a quick glance at the table above should reassure you that you have coped with much more intense weekly challenges before (remember micro economics?), as a matter of fact the session is significantly shorter than the fixed income sessions that you completed the last two weeks. That said our final weekly challenge is not to be underestimated as the content is fairly maths heavy and each page may take a little bit of time to digest.

The fist topic (Derivatives) is clearly one of the more quant oriented in the curriculum, so depending on your personal preferences you’ll probably either love it or hate it. The topic is confined to one study session made up of 3 readings (as you recall we already completed the first one on derivative markets and instruments last week). The topic is expected to take up a guideline 5% of the level 1 exam, and it’s weighting in the curriculum is roughly a reflection of that. The first of the two remaining derivatives readings is a walk through the basics of derivatives pricing and valuation. The final reading is ultra-short on risk management applications of options strategies. This study session clearly covers a lot of ground in very little space, and as such the topic very much works as a high level introduction and primer for more to come at level 2 and 3.

Alternative Investments is the smallest topic area at level 1 with just a single reading taking up little more than 2% of the curriculum. The topic is expected to carry a 4% weight at the exam, so well worth it to pay attention here. The reading introduces various alternative investments including real estate, private equity, hedge funds etc.

Tip:

The basics of derivative pricing and valuation reading appears to be slightly more testable (judging by the ratio of end of chapter questions and LOS to curriculum pages) than the rest. As always, take this information with “a pinch of salt”, as the CFA Institute is free to skew the exam towards any reading they like, and as such there is really no way around you having to be familiar with all corners of the curriculum.

Let’s have a final look at our beloved study approach (you are going to miss it!):

- Please ensure that you write down and answer the LOS as you work your way through each reading. The combined effort of question practice and LOS statement “hunting” will ensure that you are focused on seeking out the most important information as you progress through each reading. Once you are done with each reading flick through the flashcards and make a note in your question log about those flashcards that you are still struggling to answer.

- Also, please ensure that you attempt the end of chapter questions from the curriculum as soon as you finish each reading. As you answer the questions make a note in your question log about the most difficult ones (especially whenever you resort to guessing). When you are done with the questions, review your answers thoroughly (particularly those that you got wrong) and add these questions to your question log as well.

- Lastly, as you wrap up each reading attempt only the challenging flashcards and end of chapter questions from your question log. Revise your answers and make a note of those that you are still struggling with. Continue this same process each day until you can answer all with confidence.

Please remember to record your progress in your week 15 progress report.

In week 16 we are beginning our first out of six weeks of revision.