CFA® exam results’ day is almost as unnerving as the actual exam day for most people. If you are working in an office where most people know that you sat the exam, it can feel like there is nowhere to hide. I know a candidate that took the day off because the pressure was too much, in the end he passed, so he worried for nothing.

What happens on the day the CFA® exam results are published?

The results are distributed to the email address that the CFA Institute have got on file for you after 9am ET on the relevant day. There is no guarantee that your email is going to show up exactly at 9am however, sometimes it can take several hours which adds to the fun… If you sat the June 2015 test, you can also access your CFA® exam results at this location. Hopefully your exam performance met the CFA Institute minimum passing score (MPS) which means you have passed the test, congratulations! You will receive a score sheet with information about the actual topic weights at the exam (these may deviate slightly from the guideline topic area weights explained here). The score sheet will also communicate your score range for each topic area of the curriculum, the score ranges are defined as (≤50%, 51%-70% or >70%). As you can see the top range for each topic area is >70%. In the past, some people have erroneously interpreted that 70% must then be the general minimum passing score (MPS) for the test, this is however not the case.

And if I fail?

Hopefully you will never be in this situation, but if you did not pass the exam you will receive additional information about your score band. The score band is essentially dividing the population of candidates that did not pass into deciles with scores allocated from 10 (nearly a pass) to 1 (far from it..). Receiving a band 10 score is probably one of the most frustrating experiences known to CFA® exam candidates. It essentially means that had your decision to put a pencil mark under A instead of B on that final question turned out otherwise, you would likely have breezed through to the next level, but instead you will now have to suffer through another bout of CFA® exam prep, not cool! If you do not agree with your result you can ask for a retabulation of your result by filling in a form on the CFA Institute website and paying a $100 fee. Not surprisingly given the amount of painstaking detail the CFA Institute goes through in order to ensure accurate and fair grading I have yet to hear about anybody going down this route successfully.

Pass Rates

The CFA® exam level 1 pass rate has averaged 39% over the last 10 years. From this perspective the latest two pass rates have been relatively generous at 44% in December 2014 and 42% in June 2015. This is however no indication of the pass rate for the December 2015 exam. The pass rates have fluctuated over time as you can see in the below chart. E.g. a pass rate of 46% in June 2009 was followed by a pass rate of just 34% in December the same year.

Source: CFA Institute

Why do we have to wait so long for the CFA® exam level 1 results?

A great source of frustration when I was sitting the exams was the long wait between exam day and the day results were published. It seems pretty odd, particularly for level 1 and 2 when you are handing in multiple choice answers. In an ideal world you would imagine these could be machine read and graded pretty much on the spot. This is particularly frustrating if you are waiting for your CFA® exam level 1 results from June, and want to be sure if you are able to start studying for the CFA® level 2 exam the following June, or need to resit level in December.

The CFA Institute provide the following explanation for the 8 week wait: All exams are being shipped back from the exam locations across the world to be graded together centrally by the CFA Institute. The score sheets are then individually reconciled with the exam attendance rosters and the answers are machine read before undergoing multiple quality control processes to ensure accurate grading during the first 2 weeks. All comments and complaints related to the exams are investigated during the same period. If one of the exam questions is determined to be confusing or unfair all answers are credited. If a question is determined to have more than one correct answer, all correct answers are credited. I am pretty amazed that some people have got the time and mental capacity on exam day to remember enough details about an ambiguous question to be able to file a complaint about it afterwards, but as described this effort could potentially be rewarded by an extra point. The third week is spent on more quality control. Once the majority of level 1 papers have been graded the CFA Institute asks a group of CFA charterholders to independently review the exam questions to form an opinion on what the minimum passing score (MPS) should be. This process lasts another 2 weeks. During weeks 6 and 7 the board of governors review this recommendation and determine the MPS for the exam. The results are then finally published in week 8.

So, that is the official explanation. The most important point is that a lot of precaution is taken to ensure that the grading is fair and unbiased.

The 40/60/80 rule

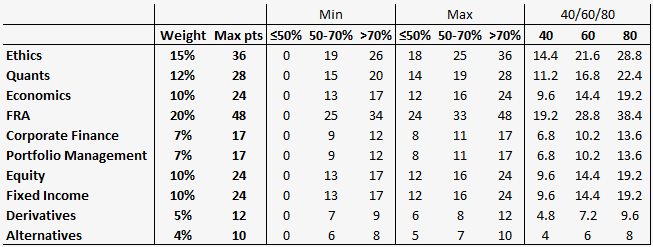

The 40/60/80 rule was popularized by the guys over at 300hours. As mentioned the CFA Institute does not provide you with your exact exam score. Instead you will receive a score range for each topic area. If you would like to have a rough idea about your real exam score, and have a bit of extra time on your hands, you can devise a basic calculation to work out what your score is likely to be. The basic 40/60/80 goes something like this:

≤50% is translated to 40%, 51%-70% is translated to 60% and >70% is translated to 80%. Simple as that.

Once you have translated the scores you can then work out your estimated exam score by multiplying the translated exam scores with the relevant topic weights.

At the risk of complicating something that is really fairly simple. The table above illustrates the minimum, max and 40/60/80 amount of points that you are able to score in each topic area within each score range based on the June 2015 guideline exam weights. Based on this you can calculate your own minimum, maximum and 40/60/80 score for the test dividing your total min, max and 40/60/80 score with 240. You obviously cannot earn fractional scores, but this is meant to be an approximation and nothing more. To be honest there is not really much to be gained from this exercise, the score range between max and minimum scores is going to be fairly wide, and there is no guarantee that the 40/60/80 estimate reflects your actual score, but if you like geeking around with numbers, this will make top entertainment for a Saturday afternoon now that you no longer need to study the curriculum 🙂

Various people have made attempts at collecting a large sample of scores to try and work out the likely level of the minimum passing score. E.g. one of the members on Analystforum posted a spreadsheet to capture results from the December 2014 test. There are obviously plenty of issues with this type of an approach, the most important being that there is no verification check of the data entered. Similar attempts that I have come across would typically put the minimum passing score (MPS) somewhere marginally below 70%. I will try not to overemphasize this point, as (1) all you can get from this type of analysis is a very rough estimate with potential biases (2) the MPS is set independently for each test, so even if you could accurately predict the previous MPS it still wouldn’t predict the MPS at the upcoming test.

I hope this post has helped explain some of the potential questions you may have around the CFA® program level 1 results. Please feel free to reach out directly at info@financialexamacademy.com or post questions in the comments. Also, if you are studying for the upcoming test you can join the email list in the side-bar to get weekly updates with study tips for the test.