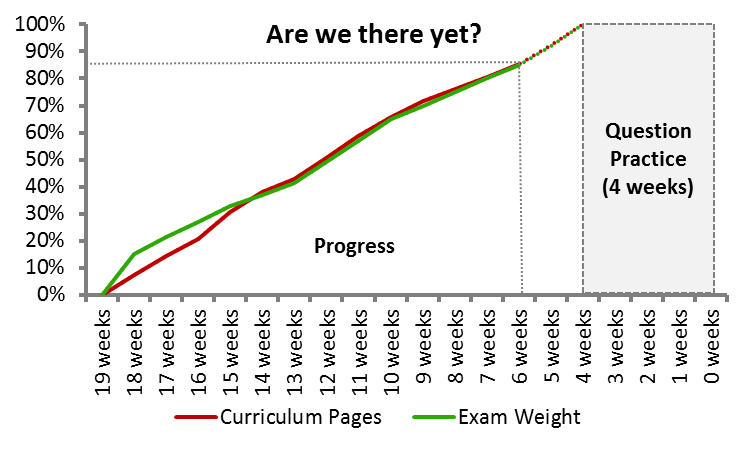

We are rapidly approaching the light at the end of the tunnel. The chart below depicts the current state of affairs with two more weeks of reading on the to do list:

The week to come:

As mentioned last week, the fixed income topic area is divided into two separate study sessions. The second study session is also divided into 4 readings. The first reading (50 pages) introduces basic fixed income valuation principles. The following reading (72 pages) walks through different yield measures, the concept of bootstrapping and an introduction to forward rates. The next reading (56 pages) explains key measures of interest rate risk (most notably duration and convexity). Finally the last reading (50 pages) is a new entry at level 1 this year on the topic of credit analysis.

There is really not a great deal of insight to be gleaned from the relationship between the size of the individual readings and the number of end of LOS and end of chapter questions in this study session, as the relationship appears fairly evenly distributed.

Just as a reminder here is the trusted study approach that we have applied throughout the study program:

- Please ensure that you attempt the end of chapter questions as the first thing when going through each reading. As you answer the questions make a list of the most difficult ones (especially whenever you resort to guessing). When you are done with the questions, review your answers thoroughly (particularly those that you got wrong) and add these questions to your list as well.

- Also please ensure that you write down and answer the LOS as you work your way through each reading. The combined effort of question practice and LOS statement “hunting” will ensure that you are focused on seeking out the most important information as you progress through each reading.

- Lastly as you wrap up each reading attempt only the challenging end of chapter questions from your list. Remove those answers that you can now confidently answer correctly from the list, and if there are any questions left read the explanations thoroughly before you redo them. Continue this process until you have mastered all of the end of chapter questions in the reading. Save away the full list of difficult questions for future use in the revision process.