The Corporate Finance topic area that you have nearly completed last week makes up 7% of the estimated exam weight, as a result we are now roughly 2/3 of the way through the curriculum. At this stage you may be feeling like you are beginning to forget some of the concepts that you studied earlier in the process. This is completely normal, but the fact that you have diligently worked to master every single LOS and EOC (End of Chapter) question in the first 11 study sessions should provide you with some confidence. In addition the fact that you are keeping up with the pace of this program means that you will be securing yourself 6 weeks of revision and question practice leading into the exam. If you utilize those 6 weeks efficiently you should be able to refresh your memory ensuring that you are in peak shape for the test.

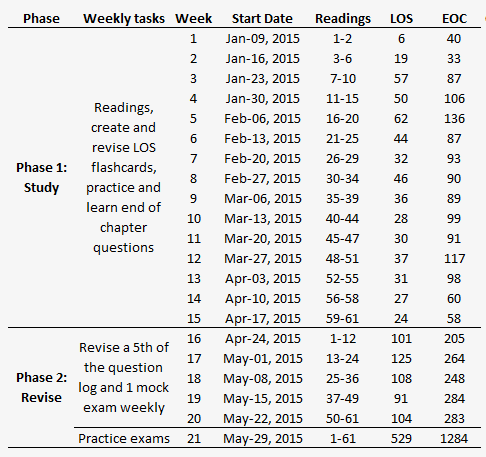

Before we move on to this week’s challenge let’s have another high level glance at your progress so far. Don’t forget to report your achievements from last week in your week 9 progress report. As you can see from the diagram below, we will be through the curriculum in 6 more weeks, and apart from the first set of fixed income readings the remaining weeks are going to be fairly light in terms of reading intensity compared to what you have been used to earlier in the program. Exploit this opportunity to really concentrate on comprehending the material, rather than cutting back on the effort. And in the (unlikely) event, that you are finding yourself with time left over, go back and practice the tricky EOC questions that you have listed throughout the process, particularly those from the essential Ethics and FRA readings.

Source: Financial Exam Academy (Based on the CFA® level 1 exam curriculum – June 2016 Exam)

The week to come:

As you have probably already gleaned from the diagram above, we are going to cover the last Corporate Finance reading and the first 4 readings of Portfolio Management this week. You may find it surprising to know that the Portfolio Management topic area only makes up 7% of the estimated exam weight for the level 1 exam. The topic area gradually grows in significance as you progress through the 3 levels (At level 2 portfolio management makes up 5-15% of the guideline exam weight, and at level 3 portfolio management makes up roughly half of the entire exam), so it is definitely worth-while paying attention here.

The Portfolio Management topic area is organized as 1 study session subdivided into 5 readings, but first we need to complete the final reading in the Corporate Finance study sessions about Corporate Governance. This reading along with the first Portfolio Management reading (Providing an overview of the PM function) are relatively light. The second portfolio management reading is the only new reading in the 2016 curriculum. Please make sure that you pay extra attention to this reading. There is no absolute guarantee that the CFA Institute is going to test the new reading, but if they are not, why would they include it in the curriculum in the first place? The next two readings (Risk and Return, Part 1 and 2) delve into more details about risk and return concepts linking them to the CAPM Model. These two readings are pretty heavy in terms of reading intensity and contain a lot of end of chapter questions and LOS.

As always we are going to apply our standard study approach to master this topic area as well:

- Please ensure that you write down and answer the LOS on flashcards as you work your way through each reading, write the book-, reading-, page and LOS number on the back of the flashcard. I explain why I think flashcards are so important in this post. The combined effort of EOC practice and LOS statement “hunting” will ensure that you are focused on seeking out the most important information as you progress through each reading. Also make sure to create flashcards with key concepts and formulas, the same way we have done it the other weeks. Flick through your flashcards once you are done with each reading, and revise and make a note in your question log of those that you are struggling with.

- Please ensure that you attempt the EOC (End of Chapter) questions once you have completed each reading. As you answer the questions make a note in your question log of the most difficult ones (especially whenever you resort to guessing). When you are done with the questions, review your answers thoroughly (particularly those that you got wrong) and add these questions to your question log as well.

- Lastly on the day after you have wrapped up each reading attempt only the challenging flashcards and EOC questions from your question log. Revise your answers and make a note of those that you are still struggling with. Continue this process for as many days as required until you have mastered all.

Don’t forget to report your achievements this week in your week 10 progress report.

In week 11 we are completing Portfolio Management and beginning Equity Investments.