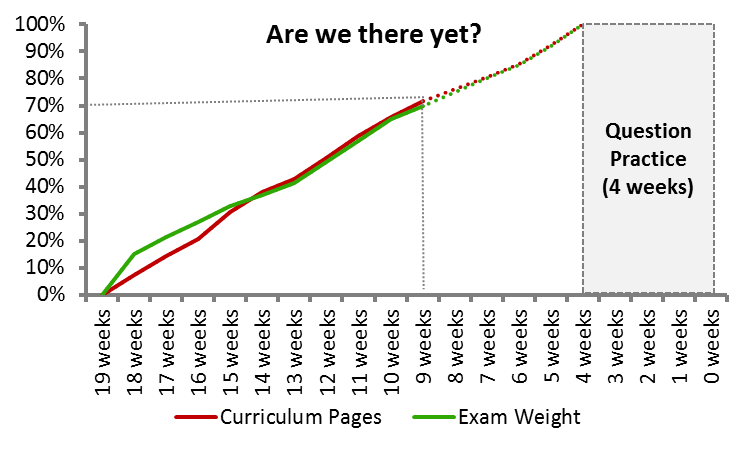

With portfolio management done, we have only got 30% of the curriculum left to cover in the 5 remaining weeks before we turn to the 4 weeks of question practice and revision for the test. If you have remained committed to the program week-in and week-out since the beginning, you are on the right track.

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum)

The week to come:

The equity investments topic area is split in two study sessions, that are further subdivided into 6 readings (3 in each). This week we are going to cover the 3 readings in the first study session. The first reading (82 pages) contains a slightly long-winded introduction to market organization and structure (covering everything from the essential functions of the financial system to how trade orders are processed). The second reading (42 pages) covers security market indices (how they are constructed, defined and used). The final reading (36 pages) delves into a discussion about market efficiency (defining forms of market efficiency and examples of market anomalies).

The introductory reading about market organization & structure is clearly the biggest reading in the study session. Conversely the reading about security market indices is roughly half the length but contain roughly an equal amount of end of chapter questions and LOS statements. There is no guarantee that the security market indices reading is going to have a relatively higher density of exam questions, but it probably won’t hurt to pay a little bit of extra attention when studying it.

We are going to apply our standard study approach to master this study session:

- As always, please ensure that you attempt the end of chapter questions as the first thing when going through each reading. As you answer the questions make a list of the most difficult ones (especially whenever you resort to guessing). When you are done with the questions, review your answers thoroughly (particularly those that you got wrong) and add these questions to your list as well.

- Also please ensure that you write down and answer the LOS as you work your way through each reading. The combined effort of question practice and LOS statement “hunting” will ensure that you are focused on seeking out the most important information as you progress through each reading.

- Lastly as you wrap up each reading attempt only the challenging end of chapter questions from your list. Remove those answers that you can now confidently answer correctly from the list, and if there are any questions left read the explanations thoroughly before you redo them. Continue this process until you have mastered all of the end of chapter questions in the reading. Save away the full list of difficult questions for future use in the revision process.

Good luck with your studies!