The curriculum is updated every year for the June test which makes it super important that you are not relying on dated study aids. This year the changes to the level 1 CFA® exam curriculum are more dramatic than usual as the number of readings has been reduced and the guideline exam weights for the individual topics have been adjusted for the first time in years. You can find an updates list of study sessions and LOS from the CFA Institute at this location.

We have analyzed and compared the 2014 and 2015 curriculum to provide you an update on the exact changes to topics, readings and Learning Objective Statements (LOS) if you are re-sitting the test or contemplating using last years materials (don’t do it..)

To my knowledge the CFA Institute has never publicly declared if the newly added material is more likely to be tested, but it would not be surprising if the institute was keen to test new material, otherwise why put it in the curriculum in the first place? In my mind this is reason enough to pay extra attention to the new readings and LOS added for the June 2015 exam.

Changes to Readings

So, what did in fact change?

- The Ethical and Professional Standards readings have been updated to reflect the latest Standards of Practice Handbook.

- Two readings from the dreaded Financial Reporting & Analysis topic area have been removed (Financial Reporting Quality: Red Flags and Accounting Warning Signs & Accounting Shenanigans on the Cash Flow Statement) and replaced by a single reading (Financial Reporting Quality).

- A new reading has been added to Fixed Income again this year (Introduction to Asset-Backed Securities).

- Four Derivatives readings have been removed (Forward Markets and Contracts, Futures Markets and Contracts, Option Markets and Contracts & SWAP Markets and Contracts) and replaced by a single reading (Basics of Derivative Pricing and Valuation).

Changes to Learning Objective Statements (LOS):

In terms of LOS 38 new LOS have been added, 6 have been amended and 39 have been removed. So on balance you need to learn one less LOS than last year (who said the CFA institute does not have your back?). These changes to LOS affect 10 out of the 18 Study Sessions in the curriculum.

Changes to Guideline Exam Weights:

Last but not least, the CFA institute has decided to alter the guideline exam weights marginally affecting four of the ten topic areas. This is interesting as these weights had otherwise remained fixed for many years. The changes are not massive, but Portfolio Management and Alternative Investments have been bumped up by 2% and 1% respectively, while Fixed Income and Corporate Finance have been reduced by 2% and 1% respectively. It is interesting that the Portfolio Management exam weight has increased by 2% without any changes to the underlying readings and LOS. This would imply that studying the Portfolio Management segment in detail does (everything else held constant) provide a better pay off than it used to. Conversely for fixed income a new reading and 8 new LOS have been added while the guideline exam weight has been reduced by 2%. I would still recommend that you study the new reading in detail, but the overall payoff from focusing on Fixed Income has reduced in relative terms.

2015 curriculum:

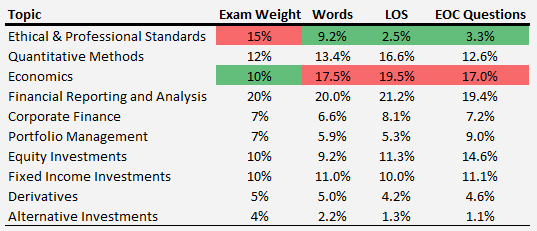

You can see the new guideline exam weights in the second column of the table below. We have also cross-examined the curriculum and worked out the percentage of words, LOS and end of chapter questions in each topic area. This should give you a rough idea about the relationship between each topic area’s size in the curriculum compared to the guideline exam weight. As you can see Ethics is emphasized very strongly in terms of its guideline exam weight compared to its size in the underlying curriculum. On the flip side of this relationship Economics takes up roughly 17.5% of the curriculum pages, while the guidelines exam weight is only 10%. So there is a clear incentive to spend more time investigating each page in the Ethics topic area compared to Economics. If you have signed up for FEA Elite, you will know that we recommend using a study guide (our preferred choice is Wiley CFA Exam Review Products), when studying for the exam, but we still think it is worth it to cover ethichs in the underlying curriculum, given the favourable time/effort pay-off.

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2015 Exam)

Which Topics Should I Prioritize?

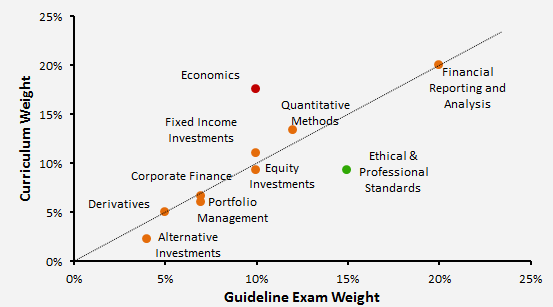

The chart below provides a more visual representation of the same relationship (the curriculum weight is based on word count). As you can see Economics stands out taking up way more space in the curriculum compared to what is warranted based on its guideline exam weight, while the opposite holds true for Ethics. You will also notice that Financial Reporting and Analysis (FRA) takes up a full 20% of the curriculum as well as the guideline exam weight. You cannot afford to lose too many points in this topic area as it will have the highest impact on your final score.

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2015 Exam)

Please leave a comment below if you have got any questions about the 2015 curriculum.