Now that you are done with the dreaded financial reporting and analysis (FRA) topic it is time for a big pat on the back. If you have followed the instructions and mastered both the ethics and FRA topics you should be in good shape.

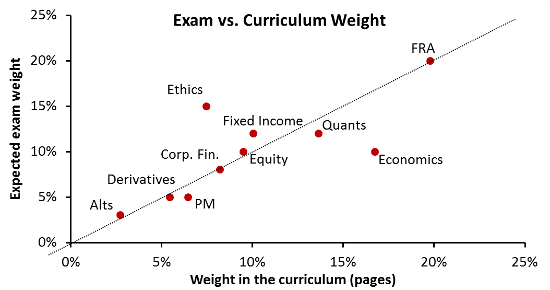

We discuss this in more depth elsewhere on the site, but basically the below scatter plot depicts the relationship between expected exam weight and curriculum weight (pages) for the 10 level 1 CFA® exam topics. As you can see FRA is the “heaviest” topic area on both measures, whereas Ethics is by far the topic area with the largest expected exam weight (15%) relative to its curriculum weighting (7.4%). You cannot afford to “mess up” any of these two, conversely a solid score on both topic areas will help propel you towards the desired exam result.

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum)

The week to come:

This week we are covering the corporate finance topic, the topic area shares space with portfolio management in curriculum book number 4, and contains 6 relatively short readings (between 28 and 44 pages each). The topic area is focused on the financial decisions of corporations in their pursuit to maximize shareholder value and in some cases (depending on corporate governance framework) broader stakeholder value as well.

The first 2 readings (capital budgeting and cost of capital) feature very heavily in terms of the number of LOS end of chapter questions compared to the remaining readings. The last two readings (working capital management and the corporate governance of listed companies) are particularly light on end of chapter questions. There is obviously no guarantee that the readings will be skewed in the same direction in terms of their weighting on the exam day, but it probably will not hurt paying extra attention to the first 2 readings.

We are going to use our standard study approach to master the corporate finance readings:

- As always please ensure that you attempt the end of chapter questions as the first thing when attacking each reading. As you answer the questions make a list of the most difficult ones (especially whenever you resort to guessing). When you are done with the questions, review your answers thoroughly (particularly those that you got wrong) and add these questions to your list as well.

- Also please ensure that you write down and answer the LOS as you work your way through each reading. The combined effort of question practice and LOS statement “hunting” will ensure that you are focused on seeking out the most important information as you progress through each reading.

- Lastly as you wrap up each reading attempt only the challenging end of chapter questions from your list. Remove those answers that you can now confidently answer correctly from the list, and if there are any questions left read the explanations thoroughly before you redo them. Continue this process until you have mastered all of the end of chapter questions in the reading.

Good luck with your studies!